Alation for Financial Services

Lead with Data Intelligence

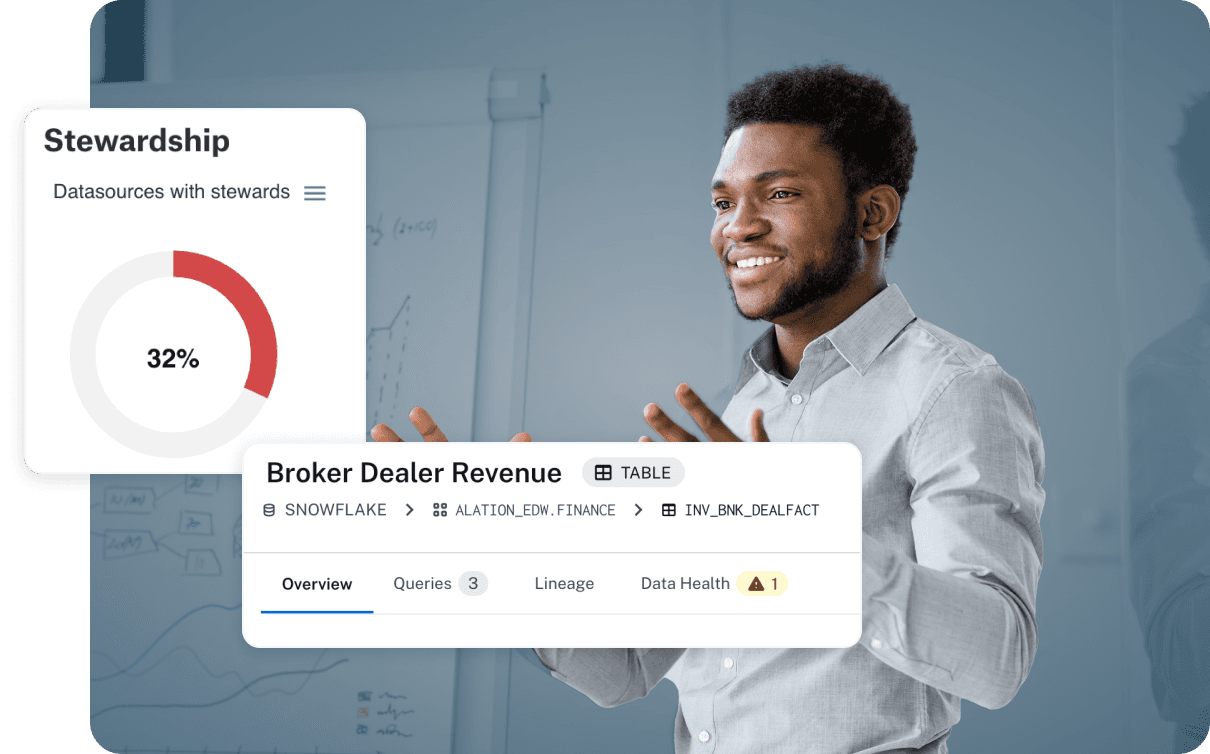

Financial Services is evolving fast. Data intelligence helps leading firms stay competitive with unified data management and a strong data-driven culture.

Alation for financial services

Alation gives every data consumer visibility into trusted data. Empower everyone in financial services to find answers on demand, make smarter decisions, and improve regulatory compliance.

Data governance trends for financial services

Deliver personalized experiences

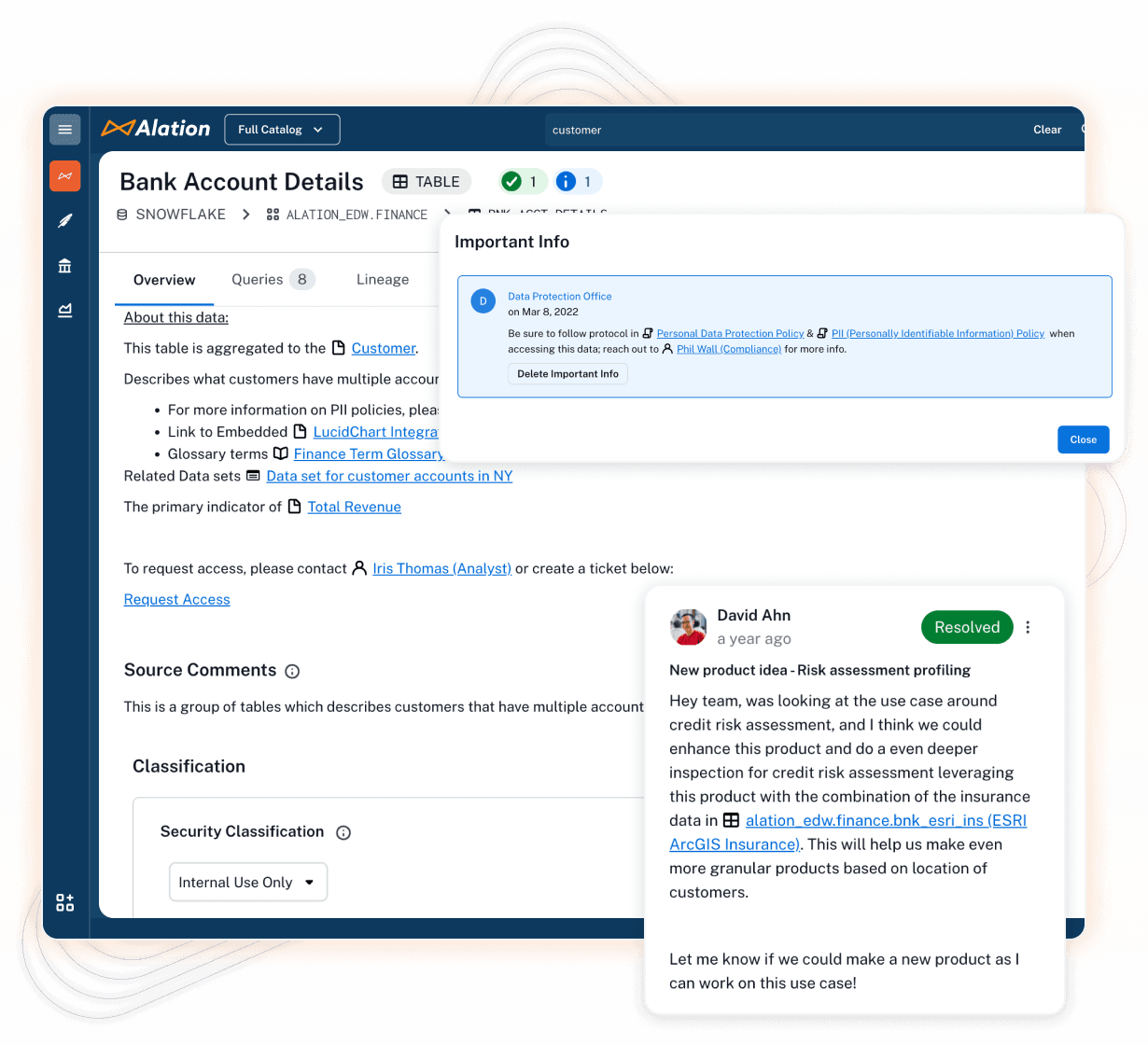

With customer data siloed in departments, many firms and agencies struggle to deliver custom products and high-quality customer service. Alation offers a 360-degree view of your data to create tailored experiences. Not to mention governance to ensure data privacy and compliance for financial information.

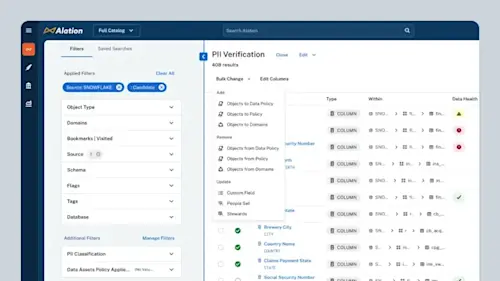

Meet regulatory demands

Fragmented governance plus growing regulation and compliance demands increase the need for risk management. Alation gives visibility into where sensitive data is managed and improves compliance processes. It also ensures active data governance to aid ongoing regulatory reporting.

Simplify CPS 230 & CPG 235 Compliance with Alation

Discover how Alation can help you strengthen your cybersecurity posture and safeguard sensitive data in line with APRA CPG 235 guidance and other data management strategies.

Power innovation with data

Improve risk modeling, streamline new product creation, and unlock the power of AI with access to trusted data that meets regulatory requirements and aligns with Critical Data Elements (CDEs). Deliver true digital transformation.

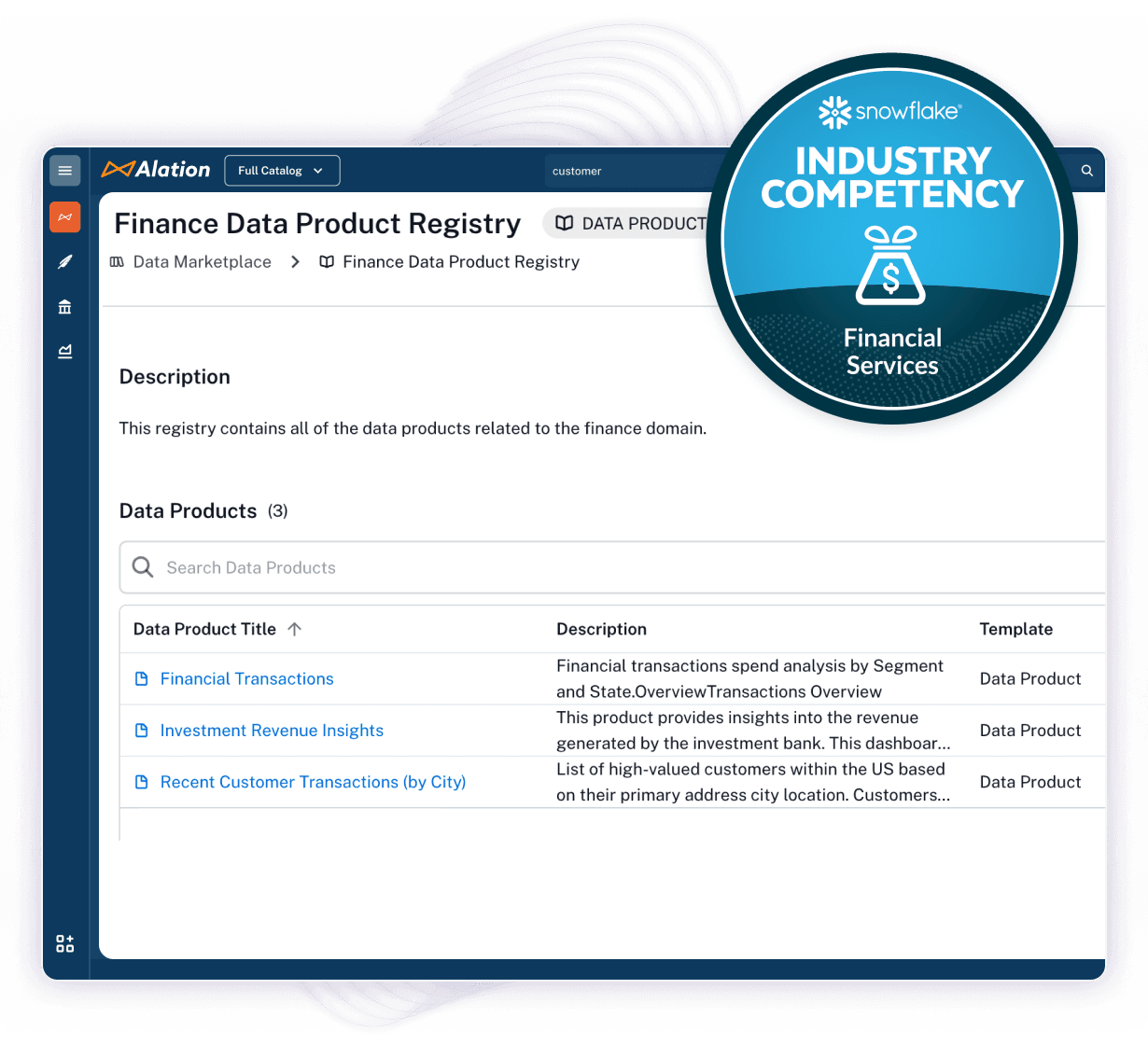

Investing in the industry

Data modernization delivers flexibility, efficiency, and innovation for financial services leaders to stay competitive in a fast-moving sector. Alation has teamed up with Snowflake to create the financial services industry’s first successful assessment of the EDM Council’s Cloud Data Management Capabilities. We are also proud to be a Snowflake Elite Partner with seven certified industry competencies, including Financial Services.

By improving the speed at which we are able to acquire and use data, we can turn that saved time into product innovations that help us remain No. 1 in customer satisfaction and delivering personalized customer experiences.

Prakash Jaganathan

Sr. Director, Enterprise Data Platforms, Discover Financial Services

Alation provides the platform and capability for stakeholders … to be able to search for the data they need, and for them to understand that the data that they need is defined such that they have confidence in using that data for their business needs.

Dr. Geraldine Wong

Group Chief Data Officer, GXS Bank

Alation reduces the time required for search and discovery of data,. If people are thinking data, I want them to think Alation. It’s the Wikipedia of information for us.

Elizabeth Friend

Senior Director, Data Governance, Sallie Mae