Alation for Insurance Firms' Digital Transformation

Master Risk with Data Intelligence

Streamline operations and improve the customer journey with data intelligence.

Alation for insurance

Insurers need to tap their vast data resources to accelerate digital transformation, develop new business models, meet customers’ evolving needs, and streamline operations. Data intelligence is the guide to putting the right data into action and navigating risk.

Optimize customer experience

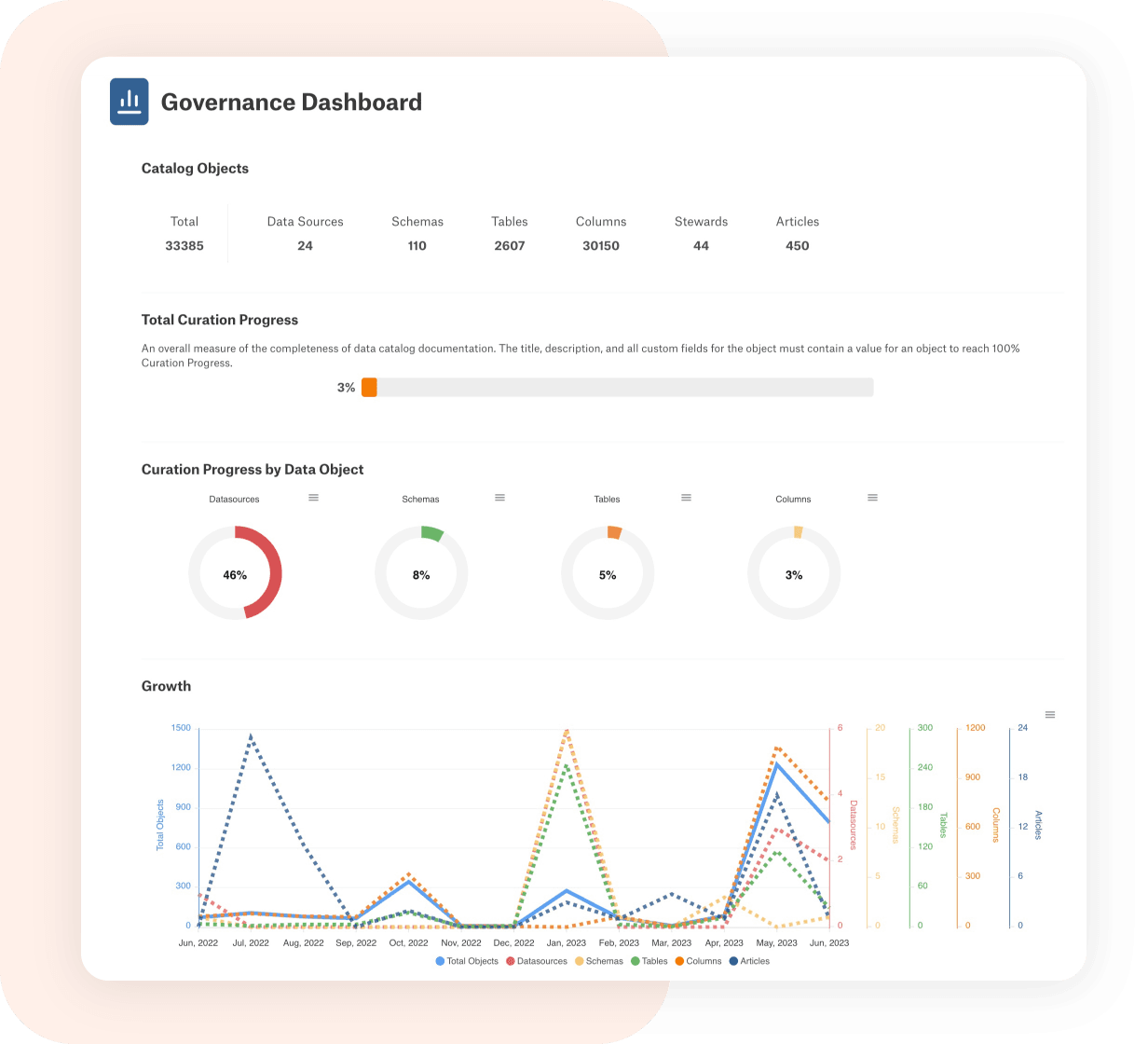

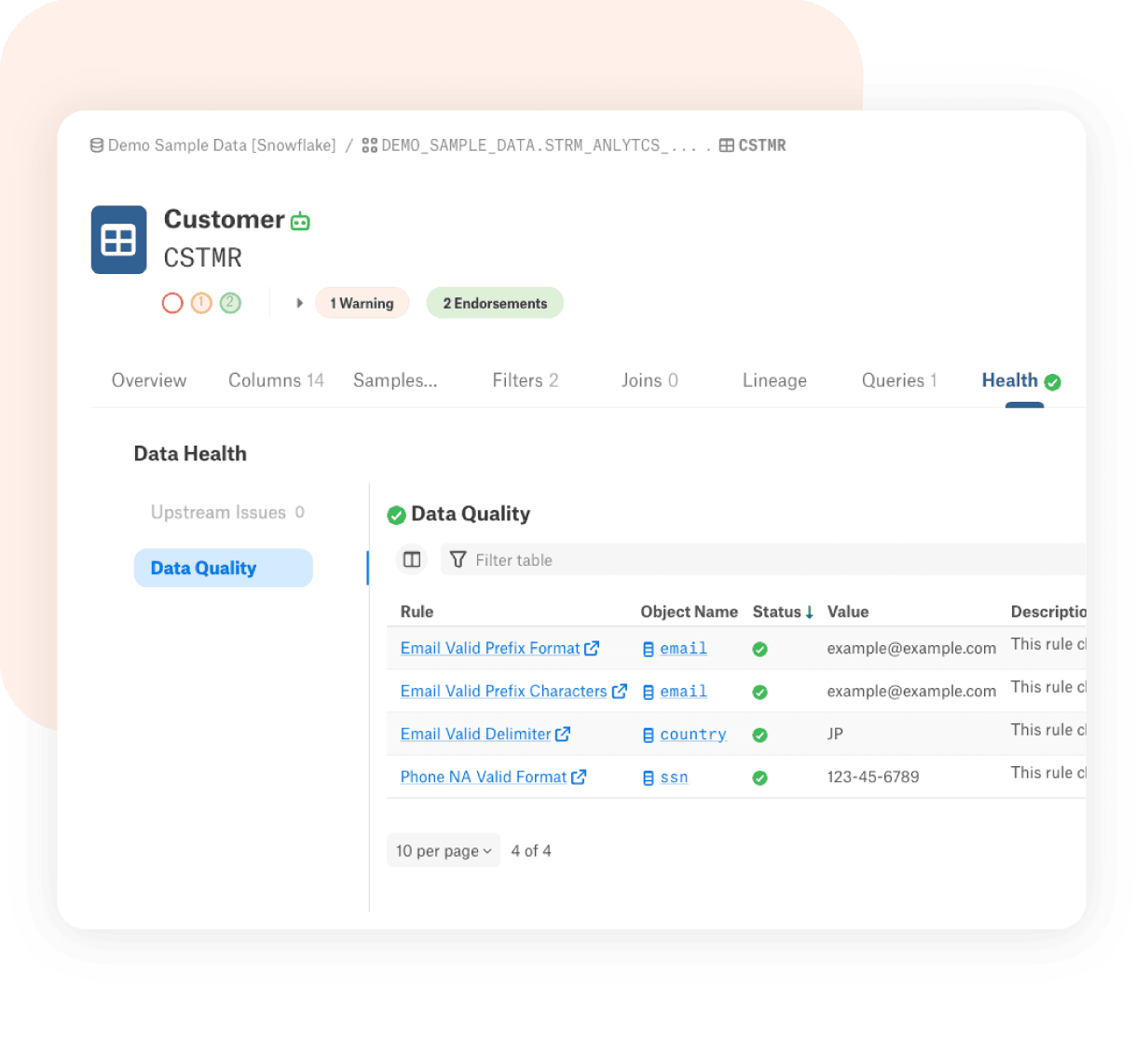

To deliver a seamless customer experience at every stage, insurers need ready access to high-quality, relevant data. Alation gives everyone an end-to-end view of the organization’s fragmented data assets and a clear picture of the current state of data quality and governance.

Understand markets and risk

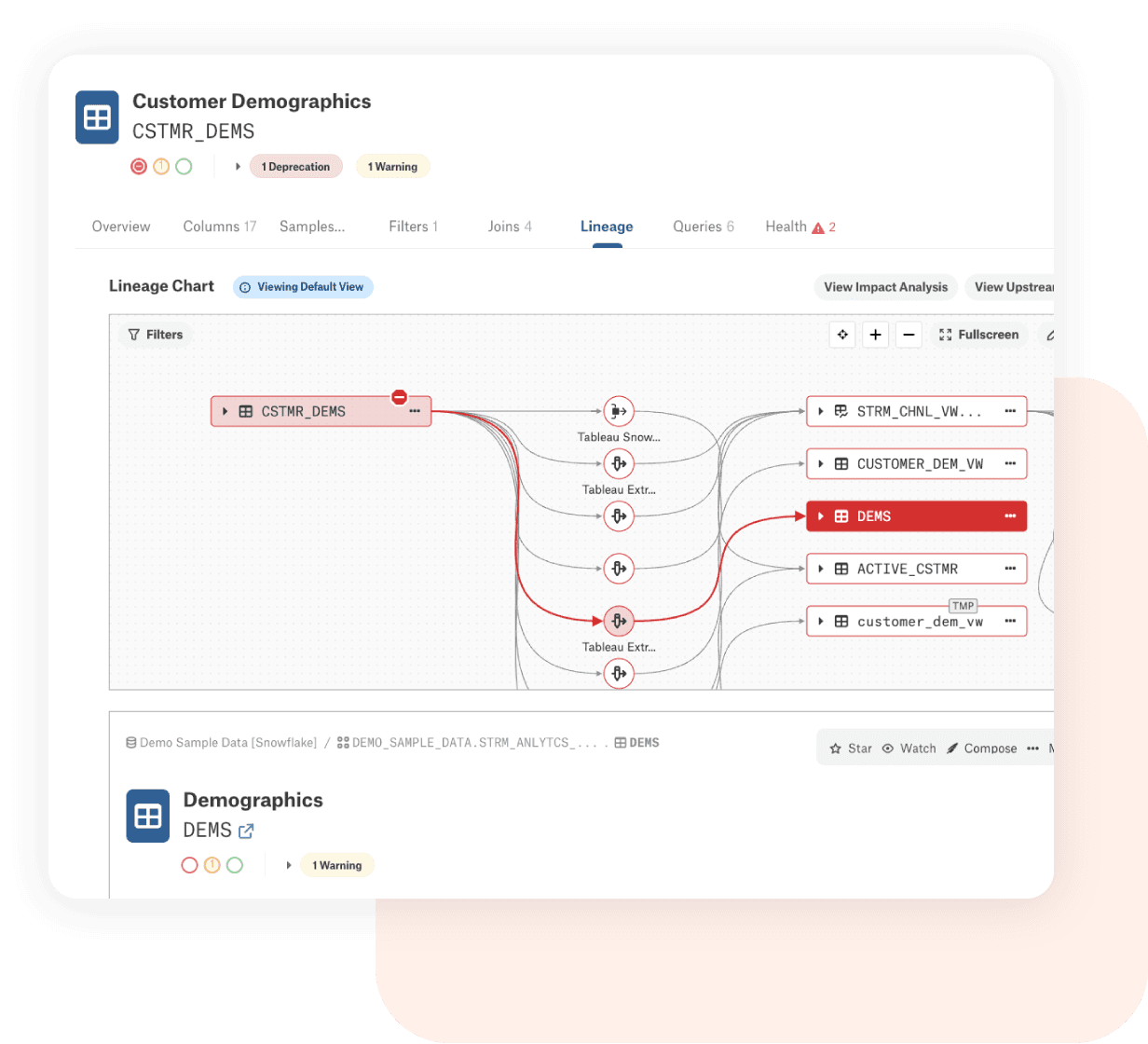

Insurers must navigate evolving risks including climate change, cyber threats, and economic conditions. Alation provides visibility to data within the organization and external data sources to guide insurers to dynamically reevaluate existing risks, and effectively predict and assess the new risks.

Streamline operations

Fragmented, ill-defined data creates complexities and can skew conclusions in claims processing and operations. Alation provides a single, real-time view of siloed data — and the definitions and data context — to put data into action to enable AI and automation and reduce decision-making friction.

Enhance data security and privacy

Insurers struggle to meet regulatory requirements due to siloed information, growing data volumes, and broadening data sources. Alation data governance identifies where sensitive data is stored, how complete and accurate it is, and how it is used and protected.